Who we serve

Condominium | Apartment

Condominium &

Apartment Claims

Condominium Claims

Condominium claims can be one of the most complex claim situations encountered. Condominiums typically carry a policy that covers only a limited amount of the building structure with the individual owners being responsible for the remaining property. Condominium claims are further complicated by various policy restrictions, associations’ bylaw requirements and occupancy issues. When dealing with a condominium complex it is advisable to have a professional address this claim from the beginning. Morrison & Morrison, Inc. has the expertise to handle complicated claims like these.

Apartment Complex Claims

Apartment complex losses usually involve one policy that covers the entire property except for the renter’s contents. Apartment complex losses can involve relocation expenses, business interruption and sometimes liability coverage. We are experts at addressing the peculiarities of an apartment complex loss.

““I am grateful to you for your help in getting more funds for the damage. No doubt, your clout as a public adjuster was the turning point in the attitude of (the insurance company) Case closed.

K.S., Pace, Florida…”K.S.

Pace, FL

“Your efforts and success in obtaining additional money means that I can actually repair my home to the condition it was before the hurricane……”

M.M.

Pensacola, FL

“Availing myself of your services was the best thing I could have done. First you removed the heavy burden of having to deal with insurance adjusters and then to detail the proof of loss in a manner that I would never have been able to do.”

R.F.

Port Neches, TX

“Thank you for all your help in dealing with the insurance people

– I don’t think we could have accomplished this on our own.”J.M

Orange, TX

“Morrison & Morrison was involved in our claim from the beginning and while our insurer initially tried to avoid and minimize the claim payment for our loss, Morrison & Morrison was persistent and doggedly pursued what we were rightfully owed.”

JR White

Settlement, TX

Schedule a free consult.

Fill out the form below and someone from our office will contact you very soon.

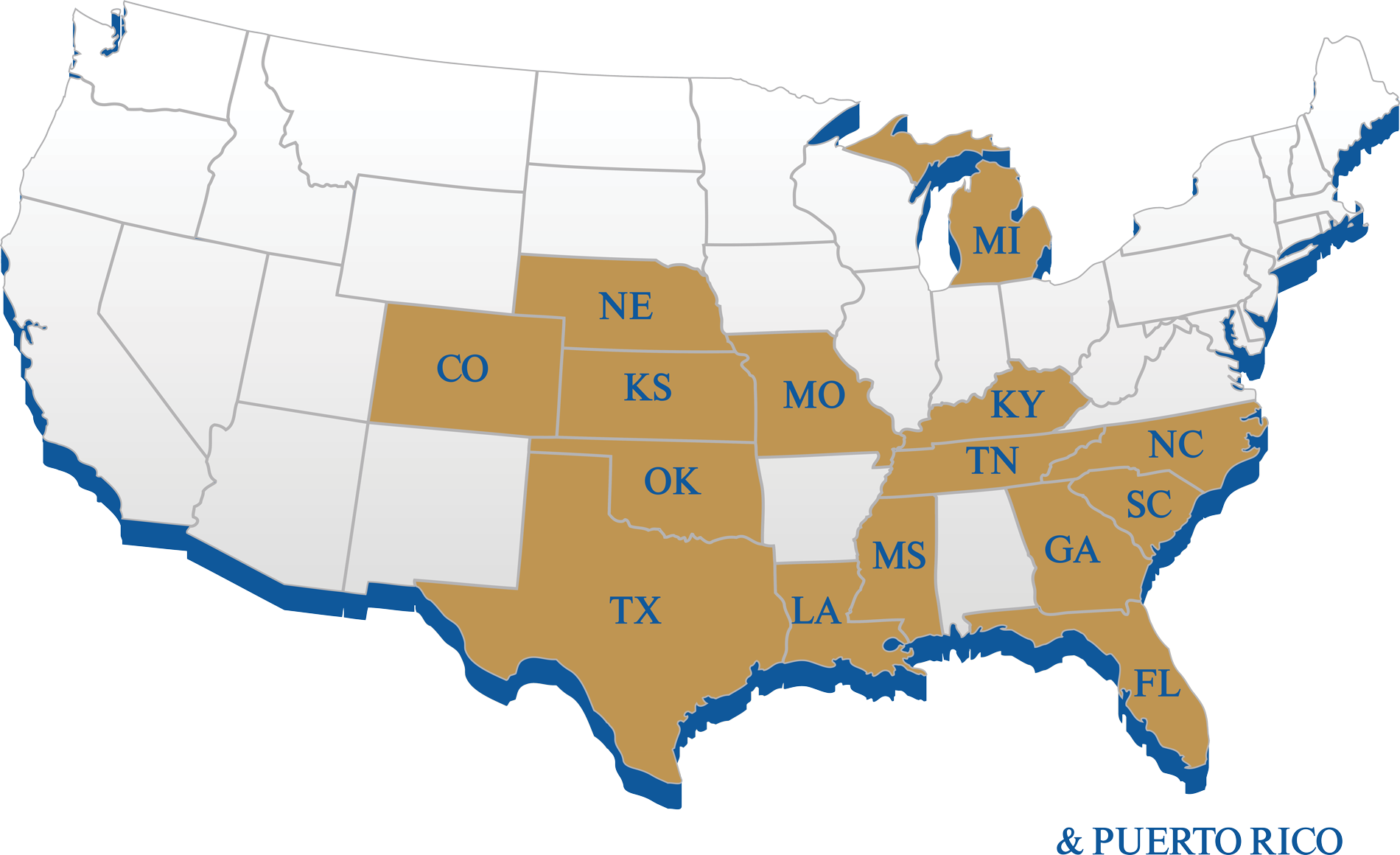

Where we’re licensed.

Our corporate office is located in Texas, our home licensing state, however we are licensed in many states across the U.S.

and we work on a national and international basis.

*Most states offer reciprocity with the home state and our firm regularly obtains reciprocal status when a client needs assistance in states where we don’t maintain an office. This leaves us free to assist just about anyone, anywhere. If you have any questions regarding our ability to assist you in your state give us a call.

**Licensing changes from time to time so call the office to determine if we are licensed in your state currently.